Context: The Central Government is preparing to launch Phase II of the National Monetisation Pipeline (NMP) with an ambitious asset monetisation target of Rs 10 lakh crore over 5 years (FY26-FY30).

What is Asset Monetisation?

1. Definition

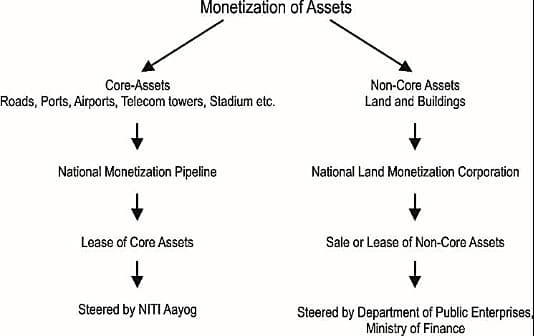

Asset Monetisation refers to the transfer of core, revenue-generating public assets to the private sector for a limited period.

This process is conducted without transferring ownership — the government retains ownership, while the private entity gets operational control for the duration of the contract.

2. Purpose

To unlock the value of underutilised or operational public assets.

The private sector is expected to bring in efficiency, investment, and innovation in managing the assets.

3. Capital Recycling

The government uses the proceeds from asset monetisation to:

Fund new infrastructure projects

Avoid additional public debt

This approach is known as capital recycling — i.e., using value from old/existing assets to build new infrastructure.

4. Key Features

No sale of public assets — only time-bound leasing or concession agreements.

Covers sectors like roads, railways, airports, ports, power, telecom, and warehousing.

National Monetisation Pipeline (NMP)

Initiative of:

NITI Aayog, in collaboration with the Ministry of Finance

NMP 1.0 (Phase 1: FY22 – FY25)

1. Objective

Raise ₹6 lakh crore through monetisation of core infrastructure assets.

2. Achievements

₹5.65 lakh crore raised (approx. 94% of the target achieved by FY25).

3. Scope

Monetisation limited to core assets — assets central to the government’s business operations.

Core sectors included:

Roads

Railways

Ports

Airports

Telecom

Power (generation & transmission)

Energy pipelines

Warehousing

Hospitality and sports stadiums

4. Exclusions

Non-core assets such as land and government buildings were not included in NMP 1.0.

NMP 2.0 (Phase 2: FY26 – FY30)

1. Target

₹10 lakh crore to be raised over 5 years.

FY26 target: ₹1.9 – 2 lakh crore.

2. Expanded Asset Base

Monetisation to cover:

Highways

Railways

Power (generation & transmission)

Petroleum and Natural Gas

Civil Aviation

Ports

Warehousing and Storage

Urban Infrastructure (housing, transport)

Coal and Mines

Telecom

3. New Focus Area

Vacant public land development through Public-Private Partnerships (PPPs).

Private partners may:

Develop land for infrastructure (e.g., housing, logistics, industrial parks)

Generate long-term revenue streams

4. Role of Consultants

A consultant will be appointed to:

Identify monetisable assets and land parcels

Estimate revenue/investment potential

Propose innovative PPP models for faster infrastructure delivery

5. Monetisation Mechanisms

Upfront lease revenues

Revenue-sharing models

Private sector capital expenditure and investments